Argo Blockchain investors sued the mining company

Investors who invested in Argo Blockchain have filed a class action lawsuit against the mining company, as the creators of the project withheld key information during their initial public offering (IPO) held in 2021.

Recently, cryptocurrency mining company Argo Blockchain faced a number of difficulties that they have to solve. At first, due to financial problems, the mining organization was forced to be sold to Galaxy Digital. The transaction value was $65,000,000.

After that, the company received a class-action lawsuit from investors. The latter claim that the management of the organization deliberately withheld key information during the IPO held in 2021. This information could change the perception of investors about the mining company and keep them from investing in the project, however, according to them, top management decided to resort to not the most honest methods of raising funds and hid important information about the electricity consumed.

According to the people who invested in the Argo Blockchain project, the management of the organization did not tell how much money they spend on maintaining the farm, and the documents for the IPO were not prepared properly. In addition, these papers contained false statements about key factors that directly influenced the decision of investors regarding whether to invest their money or not.

The top management of Argo Blockchain deliberately embellished their ambitions and created false ideas about the sustainability of the project, thereby, as it was said many times before, to motivate investors to spend their funds in favor of this project. People involved in investing in Argo Blockchain expected a more positive result from the financial prospects of the mining company.

The information that investors complain about was posted online in September 2021 along with the filing of documents for an initial public offering with the US Securities and Exchange Commission (SEC).

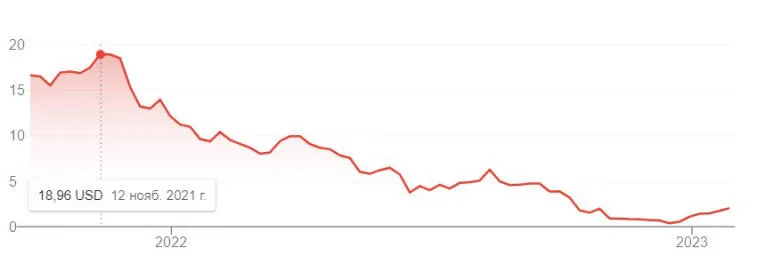

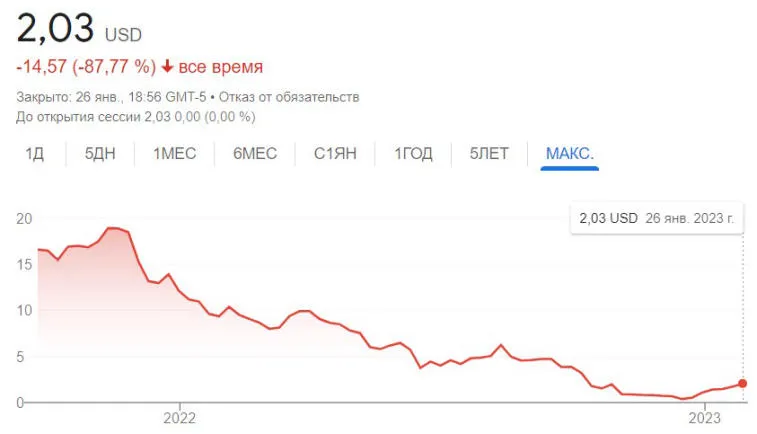

At the start, Argo Blockchain managed to enter the NASDAQ financial exchange, having managed to raise $7,500,000 at the start. Then the value of the securities was estimated at a cost of $15. A month later, the mining company’s project, along with the rest of the cryptocurrency market, began to rise and reached the $19 mark.

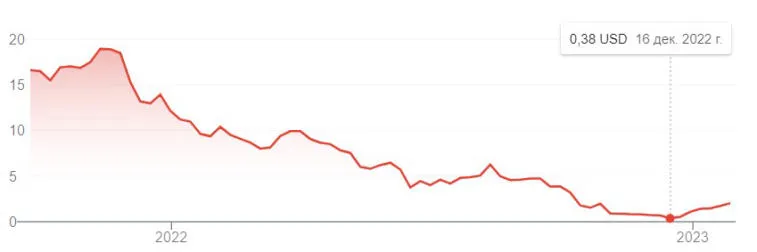

On December 16, 2022, Argo Blockchain's shares performed the worst and dropped to $0.38.

At the moment, 1 share of the mining company is valued at $2.03, which is 87.77% less than at the start of the project.

Clearly, two factors contributed to the poor performance. Firstly, the global downtrend in the digital asset market could not bypass the company, which was created in order to mine the flagship cryptocurrency. Secondly, the news about the sale of Argo Blockchain to the possession of Galaxy Digital suggests that the project is not as reliable as investors initially would like it to be.

In addition, Argo Blockchain reached its lows during the time when Will Foxley. The director of content at the above company posted a randomly sent screenshot on Twitter, according to which Argo Blockchain could file for bankruptcy. Investors did not appreciate such news and began to get rid of the shares of the cryptocurrency mining company.

Коментарі