In 2022, the profit of bitcoin miners fell by 43%

We previously reported that BTC mining power was increased by 41% in 2022. However, the level of earnings of miners leaves much to be desired. Although miners of the main digital asset from all over the world stepped up last year in order to do their job and by December the mining process was increased by 41% compared to the beginning of the year, the profitability of such an activity leaves much to be desired.

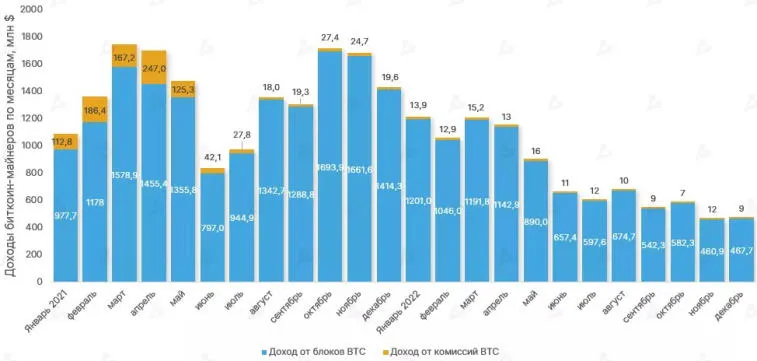

For the entire 2022, cryptocurrency miners managed to mine BTC for a total of $9,450,000,000. This is 43% less than in 2021. The result of 2021, in turn, amounted to $16,700,000,000. This is of course due to the global downtrend and the fall of the cryptocurrency market by more than 70%.

In addition to the fall in the price of BTC and other digital assets, the decrease in the profitability of miners was facilitated by an increase in the hash rate and the complexity of the blocks received. The hash rate was increased by 47.7% and the difficulty of mining BTC increased by 46%.

In December 2022, the profit of miners of the main cryptocurrency amounted to $477,000,000, which is 1% more than in November.

Glassnode conducted analytics and calculated the profitability for each month. January was the most profitable month in 2022. Then all the miners managed to earn a total of more than $1,201,000,000. The top 2 month was March, when miners earned $10,000,000 less, and the top 3 closes April with $1,142,000,000. The worst month of the past year was November with $460,000,000.

It is also noteworthy that the profit from the commissions of BTC miners decreased by 86% and amounted to only $142,200,000. In 2021, this figure was over $1,000,000,000. The reason for this is still the same – the loss of investor interest in cryptocurrencies and, as a result, low activity in the blockchain.

Due to the fact that the price of Bitcoin was reduced, and the hashrate was increased, the hashprice, respectively, fell to its historical lows, namely to the level of $0.055. This figure was recorded in early November. As a result, many digital gold mining companies decided to sell the received bitcoins in 2022, which further collapsed the cryptocurrency market in November-December.

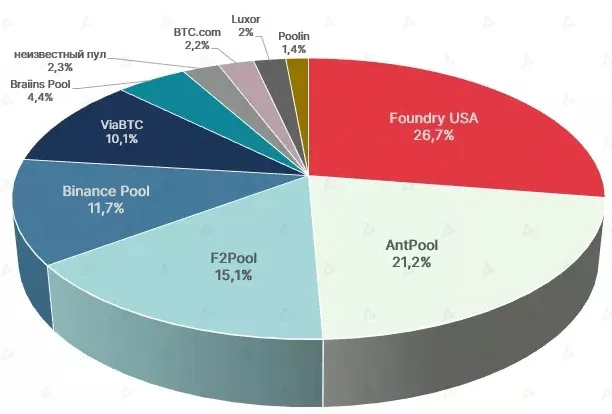

If for some miners the circumstances were bad, then others were able to find their pluses and gain a foothold in the miner market. For example, Foundry USA had a 16.5% share in the hashrate at the beginning of the year. At the end of 2022, this figure rose to 26% and topped the list of the largest mining systems. Antpool is in second place, occupying 21.2% of the hashrate, and F2Pool closes the top 3 with a figure of 15.1%.

Коментарі