Ethereum Stakers Are in Trouble

Due to the fact that Ethereum, like all cryptocurrency assets, fell against the backdrop of a global downtrend, most people who have staked their holdings are now at a loss.

Despite the fact that we can see the crypto winter for a long time, staking Ethereum has always been a popular enough activity that made sense. However, this value became directly proportional to the lower the lower the value of ETH. At the moment, a smaller part of the stakers are in the profit zone.

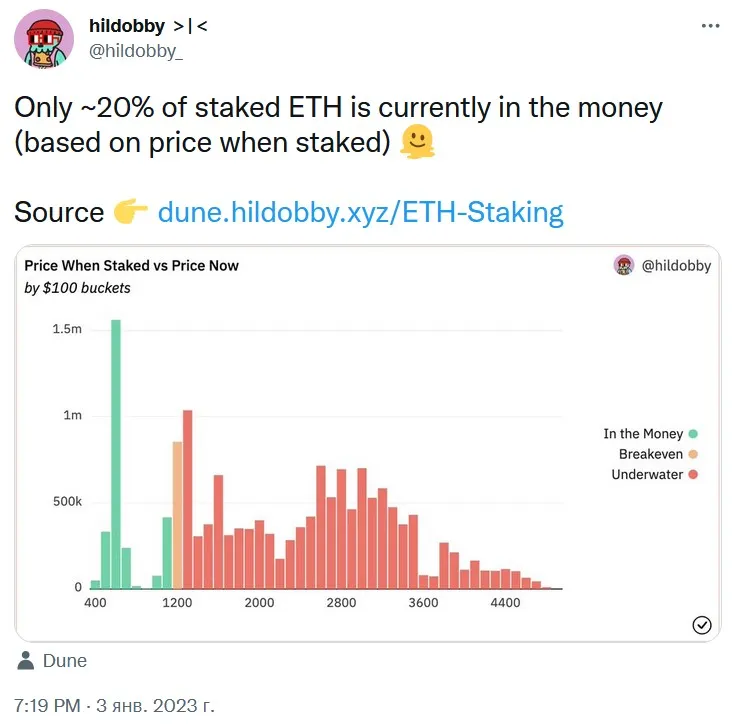

There are only 20% of such people, as reported by the analytical service Dune Analytics. The latter also said that more than 80% of people started staking their Ethereum at a price tag higher than what we can see now.

According to the same service, there are about 15,900,000 Ethereum in staking, which is equivalent to $20,000,000,000 at the current rate. This represents about 13.2% of the total ETH in existence.

The part of the community that feels the best is that in December 2020, with the launch of the Beacon Chain network, they placed the available coins in staking at a price tag of $600. Beacon Chain was created as one of the key elements in Ethereum's transition from Proof-of-Work mining to Proof-of-Stake.

PoS appeals to all environmentalists from greenhouse gas emissions, because with such an algorithm, computing power does not rely on the exhausting work of computers, which leads to emissions, but on the proof of stake of coins.

In order for users staking Ethereum at $600 to also enter the red zone, the main altcoin needs to do a good job and drop another 50% of its current value.

November was a remarkable month for those investors who invested in Ethereum and sent them to Proof-os-Stake. The developers of ETH talked about the start of the process of withdrawing coins from staking, and this function will still work in the test network mode.

March of this year will bring not only the Shanghai update to Ethereum lovers, but also the full functionality of withdrawing coins from staking. The developers decided that they would release an update without the EIP-4844 protocol. According to them, this will help remove delays in the withdrawal of funds from validators.

It is noteworthy that EIP-4844 was aimed at significantly reducing the level of commission, which means that the long-awaited innovation will be postponed until later. The Ethereum network is known for having huge transfer fees compared to what other blockchains can provide.

The mass withdrawal of Ethereum can only happen if by that time the cryptocurrency rate can rise well enough. Otherwise, the withdrawal delay will not make much sense, and the high level of commission, however, will remain

At the time of writing, Ethereum is worth $1,250. A week ago, the token was valued at $1,195 and was able to show a slight increase over the week.

Коментарі