Bitcoin fixes above $20,000 on the daily timeframe

Over the past couple of days, Bitcoin has been able to grow from an oblong flat at $19,300 to $20,700 and create a new local flat. We talk about how it happened and what can be expected from cryptocurrency in the future.

Thanks to the fact that the main crypto asset has been able to shoot up in recent days, its market cap level has managed to overcome the $1,000,000,000,000 mark. Several key factors contributed to this development.

Firstly, many traders began to express more interest towards futures trading in bitcoin after the fall of the world's main cryptocurrency to the level of less than $18,000. However, for the same fans of futures, such a pump was able to liquidate short positions, and therefore, demand for futures may fall for some time.

According to the analytical portal Coinglass, in the last hours of trading, the amount of liquidated short positions exceeded $600,000,000, while the amount of liquidated long positions did not even reach $130,000,000. This indicates more optimistic thinking on the part of traders. A day earlier, even more deals were liquidated. On October 25, short traders lost more than $700,000,000 due to forced liquidation trades.

Thus, we can see that one of the reasons for Bitcoin to rise to a new level of $20,000+ is the massive liquidation of shorts. Probably, in this way crypto whales manipulate the market and collect liquidity in the area of $20,000-$21,000 for a further downward march due to the faith of longists and adherents of the “flight to the moon”.

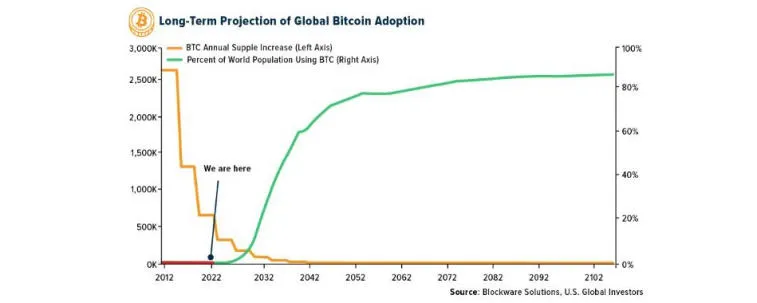

Blockware Solutions US Global Investors has also compiled a chart showing that optimistic expectations are also built around the topic of Bitcoin adoption, which

Now you can also notice that traders have become interested in bitcoin trading after almost the entire passive October. This explains why bitcoin has been sideways for the entire month.

Another reason for the rise of bitcoin may be people's confidence in raising interest rates by the US Federal Reserve by a percentage less than expected, as it happened recently. For example, a couple of weeks ago, instead of 8.2%, as analysts predicted, the increase was only 8.1%. Macromicro believes that this trend may continue in the future. Thus, the sphere of cryptocurrencies can stabilize in the future. In addition, do not forget about similar indicators between the S&P 500 and Bitcoin. If the S&P 500 continues to grow, then we can expect the same from the main crypto asset.

Коментарі