Bitcoin futures point to a bottom

Representatives of the analytical company IntoTheBlock report that now futures contracts for bitcoins are sold at a lower price than in the case of the spot value of the main cryptocurrency asset. On Twitter, IntoTheBlock representatives report that, despite the fact that there is a trend of high activity of traders in the direction of sales, arbitrage in the market is still possible.

This situation is called backwardation. It allows smart crypto traders to buy a futures contract and sell the spot, allowing them to make a profit. According to analysts from IntoTheBlock, such a phenomenon in the cryptocurrency market can be traced just as a result of reaching the bottom, after which cryptoassets begin to grow rapidly. In exactly the same scenario, Bitcoin moved in the spring of 2020 and 2021.

Now traders are actively continuing to sell BTC out of fear of a further price drop. In general, such a market situation creates a good opportunity to purchase a flagship digital asset at a better price.

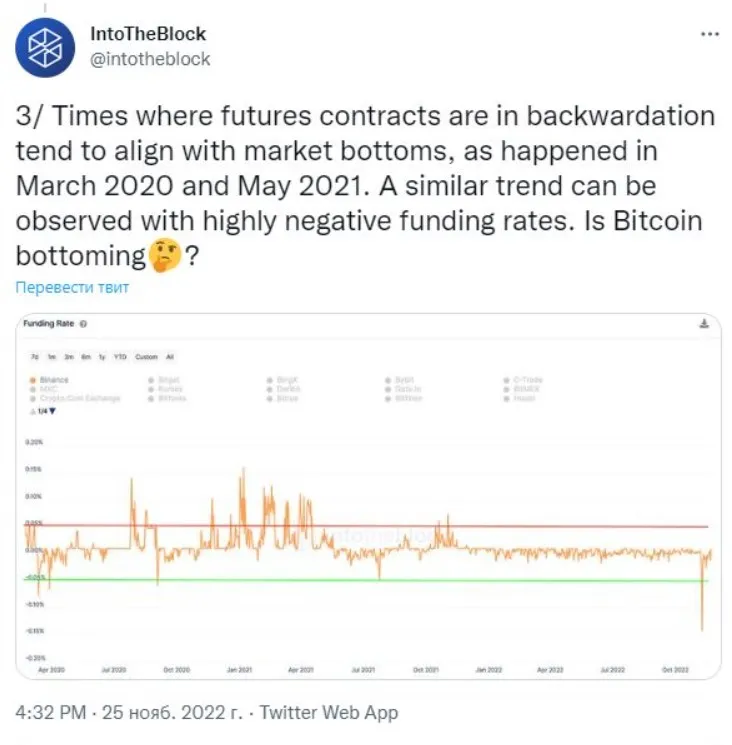

Times when futures contracts are in backwardation tend to coincide with market bottoms, as happened in March 2020 and May 2021.

A similar trend can be observed with extremely negative funding rates. Has Bitcoin bottomed out?

Коментарі